One of the most important financial decisions you make, is whether or not to open a credit card. This one decision has the potential to significantly impact your present and future financial situation. Credit cards are one of the most common ways you can build credit and finance large future financial purchases (i.e. a house or car). In addition, credit cards frequently offer perks like cash back, points, miles, and even certain insurances. However, mismanagement of a credit card often leads to financial ruin and bankruptcy.

What Is A Credit Card

A credit card enables you to borrow funds from a given financial institution in exchange for goods and services. Every month, your financial institution issues a statement listening your purchases, at which time, the expectation is full payment on the balance due. However, the terms of credit cards allow you to carry the balance into future periods, charging interest on any outstanding balance. In addition, the financial institution assigns a credit limit to each credit card; a cap on spend. The basis for the credit limit is a combination of reportable income, credit history, and previous relationships; these factors also determine the interest rate. Most financial institutions allow a cash advance via your credit card, but at significantly higher interest rates than purchases.

What Are The Different Types Of Credit Cards

The main financial institutions offering credit cards are AMEX, Bank of America, Barclays, Capital One, Chase, Citi, and Discover. There are many different types of credit cards, each with its own unique features.

Cash Back vs Travel Rewards

The simplest and most straightforward credit card is a cash back credit card. With a cash back credit card, you earn a percentage of cash back (i.e. a refund or discount) for each purchase. Typically, the cash back amount varies by purchase type (i.e. groceries, restaurants, etc.) and financial institution. The cash back payment often takes the form of an Automated Clearing House (ACH) transfer, check, or statement credit. A travel rewards credit card offers either points or miles on each purchase. Similar to a cash back credit card, point and mile earning opportunities on a travel rewards credit card varies by purchase category (i.e. groceries, restaurants, travel, etc.). The earned points and miles are redeemable for future travel (i.e. airline ticket or hotel travel).

Branded vs Co-Branded

Every major financial institution offers a self-branded credit card. A branded credit card is one of the most valuable types of travel rewards credit cards due to the flexible point currency; such as AMEX Membership Rewards (MR), Chase Ultimate Rewards (UR), etc. A flexible points currency provides multiple avenues to redeem earned points for travel: transfer to a variety of airline or hotel partners, travel portal redemptions, cash back, etc. A co-branded card is a credit card where a retailer (i.e. United, Hilton, Marriott, etc.) issues a credit card in partnership with a financial institution (i.e. AMEX, Chase, Citi, etc.). The card frequently bears the logo of both partners (i.e, AMEX and Hilton). Co-branded credit cards often skew earning opportunities and benefits (i.e. status) heavily towards the respective retailer, but all purchases earn rewards. However, unlike branded credit cards, co-branded credit cards limit travel rewards to the respective retailer.

Personal vs Business

While personal and business credit cards share many attributes, there are key differences. Both types of credit cards extend you a credit line, accrue interest, and potentially earn points, miles, cash back, or other rewards. The main difference occurs in the application process. On a business credit card application, the financial institution inquires about your legal business name, industry, legal structure, employees, revenue, Federal Tax ID (EIN), etc; in addition to your personal information. Similarly, the reward categories for a business credit card focus on business related spend (i.e. office supplies, computer hardware and software, phone and internet, etc.) versus a personal credit card which focuses on everyday spend (i.e. groceries, restaurants, gas, travel, etc.).

What Is A Credit Card Sign Up or Welcome Bonus

One of the easiest, and fastest, methods to earn points, miles, or cash back is through a credit card sign up bonus. While not every credit card offers a sign up bonus, the vast majority do. The “deal” usually looks something like this: If you spend “X” dollars in “Y” amount of time, you earn “Z” points, miles, or cash back. Often the sign up bonus is quite significant. While not a guarantee, many credit cards offer the ability to earn a sign up bonus multiple times; after a specific amount of time lapses from the last bonus payout.

Why Are Credit Cards Important

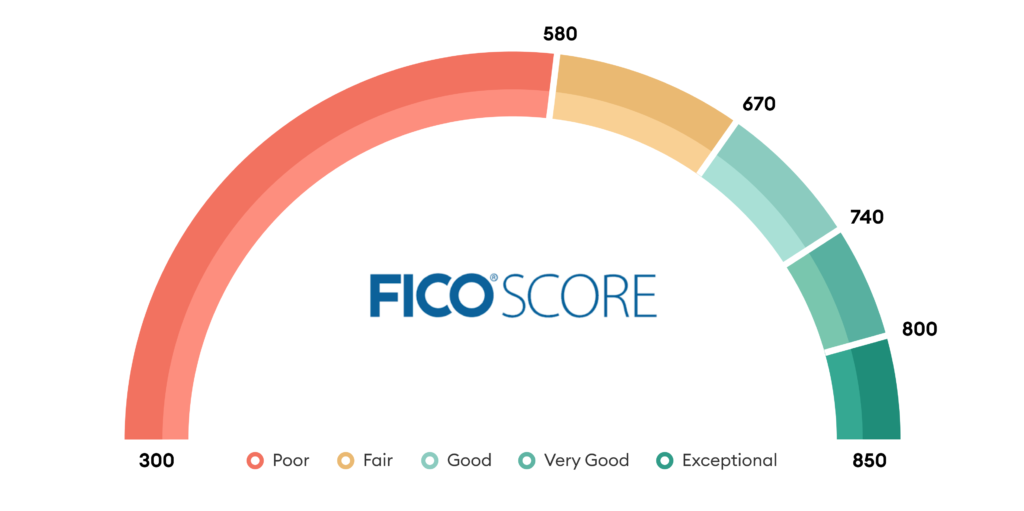

A credit card is one of the most important and influential aspects of your FICO credit score. The key components of the FICO credit score are:

- Payment History (35%): do you pay your financial obligations (i.e. bills, loans, and credit cards) on time.

- Credit Utilization (30%): what percentage of your credit limit (i.e. credit card limit) do you utilize.

- Credit History (15%): what is the average age of your credit accounts and how old is your oldest account.

- New Credit (10%): how many new accounts, or “hard inquiries” appear in the last 24 months.

- Credit Mix (10%): what diversity exists in your credit (i.e. credit cards, loans, etc.).

Your FICO score has a direct impact on all major financial aspects of your life (i.e. mortgage, car loan, future credit cards, etc.).

A distant secondary benefit of credit cards is the opportunity to earn either cash back, points, or miles on everyday spend. The cash back, points, or miles have the potential to net you “free” future travel.

What Are The Challenges With Credit Cards

The two most important rules of credit card ownership are as follows:

“Thou shall pay thine bills on time.”

AND

“Thou shalt not carry a credit card balance.”

This is one of the few areas on which every single person, either for or against credit cards, agrees. Positive usage of a credit card has the ability to significantly increase your FICO score. However, negative usage of a credit card (i.e. high balance, missing payments, etc.) has the ability to significantly decrease your FICO score. These poor financial behaviors pose the risk of creating a “credit debt spiral;’ due to compound interest. In addition, any interest immediately negates the cash back, points, or miles benefits.

Final Thoughts

There are individuals on both sides of the credit card spectrum. On one end, the anti-credit card movement argues access to money you do not have creates poor financial habits, which eventually lead to financial ruin. On the other end, credit card advocates argue access to multiple credit cards has the ability to improve your FICO score and overall financial well being. Ironically, both sides make the same point. Do not spend more than you have. With that in mind, if you spend money on groceries, gas, clothing, and other everyday items anyway, you might as well earn some cash back, points, or miles for free future travel.