Your credit score is one of the most important numbers that can impact your financial life. Whether you are applying for a loan, opening a new credit card, or even renting an apartment, your credit score is a key factor in determining how lenders and landlords assess your financial responsibility. Fortunately, checking your credit score has never been easier — or more affordable. In fact, many financial institutions and free services allow you to check your credit score without paying a dime. While many people believe they need to pay to access their credit score, numerous options allow you to check it at no cost, making it easier than ever to keep track of your financial health.

Check Your Credit Score With Your Bank

Credit. Bankwest. Check Your Credit Score With Your Bank.

Many major banks now provide free access to your credit score as part of their online banking or credit card offerings. These services typically update monthly, allowing you to monitor your score consistently. Each bank may use a different credit scoring model (like FICO or VantageScore) and pull data from different credit bureaus (Experian, TransUnion, or Equifax), so it is worth knowing where your score comes from. Here is a closer look at what you can expect from some of the leading banks:

American Express

American Express offers free access to your FICO score through its online platform for all U.S. consumer credit card holders. The score is provided via Experian, and it is updated monthly. You can view your score directly from your account dashboard or mobile app under the “My Credit Score” section. Beyond just showing you your score, American Express also provides some insights into what factors are influencing it, helping you better understand how certain actions (like on-time payments or credit utilization) impact your score. Additionally, Amex cardholders can access credit alerts, helping you stay informed of any significant changes to your credit file.

Key Features:

- Credit Score Provider: FICO Score

- Credit Bureau: Experian

- Update Frequency: Monthly

- Additional Tools: Credit Education, Credit Alerts

Bank of America

Bank of America offers free FICO scores to its eligible cardholders as part of its “Better Money Habits” program. Like American Express, Bank of America uses data from TransUnion to provide your FICO score. You can easily view your score through the mobile app or your online account, typically under the “FICO Score” section. One unique feature with Bank of America is that it not only gives you access to your score but also provides a historical view of your score over time. This allows you to track changes month over month and spot any trends, which can be particularly helpful if you are trying to improve your credit.

Key Features:

- Credit Score Provider: FICO Score

- Credit Bureau: TransUnion

- Update Frequency: Monthly

- Additional Tools: Historical Score Tracking, Credit Education

Barclays

Barclays offers free access to your FICO score for cardholders, and the score is provided through TransUnion. Barclays updates your score monthly and makes it available through both its online banking site and mobile app. Barclays also emphasizes credit education, providing users with helpful resources on how credit scores work and what factors affect them. Additionally, the platform allows you to review the key elements influencing your score, such as your payment history and credit utilization.

Key Features:

- Credit Score Provider: FICO Score

- Credit Bureau: TransUnion

- Update Frequency: Monthly

- Additional Tools: Credit Education, Insights Into Credit Factors

Capital One

Credit. Capital One. Capital One CreditWise Credit Monitoring.

Capital One offers a robust free credit monitoring tool called CreditWise, which is available to both Capital One customers and non-customers alike. CreditWise provides your VantageScore 3.0, which is based on data from TransUnion and Equifax. Unlike some banks that only offer monthly score updates, CreditWise updates your score on a weekly basis. CreditWise also provides users with credit alerts, notifying you if there are changes to your credit report (like new inquiries, changes to account balances, or new accounts). In addition, CreditWise offers a “Score Simulator” tool, which allows you to see how certain financial actions — such as paying off debt or applying for a loan — might impact your score.

Key Features:

- Credit Score Provider: VantageScore 3.0

- Credit Bureau: TransUnion and Equifax

- Update Frequency: Weekly

- Additional Tools: Credit Alerts, Credit Score Simulator, Credit Monitoring

Chase

Chase offers a free credit monitoring tool called Credit Journey, which is available to both Chase customers and non-customers. Credit Journey provides your VantageScore 3.0, based on data from TransUnion, and updates weekly, making it one of the more frequently updated tools. Credit Journey stands out by offering a detailed breakdown of what is impacting your score, with a focus on helping you understand how your credit usage, payment history, and other factors contribute to your score. The tool also provides alerts when significant changes occur, such as new hard inquiries or changes in your credit utilization.

Key Features:

- Credit Score Provider: VantageScore 3.0

- Credit Bureau: TransUnion

- Update Frequency: Weekly

- Additional Tools: Credit Alerts, Detailed Score Breakdowns, Available To Non-Chase Customers

Wells Fargo

Wells Fargo offers free access to your FICO score for cardholders, with data provided by Experian. You can access your score through the Wells Fargo online banking site or mobile app, and it updates on a monthly basis. In addition to your score, Wells Fargo offers cardholders tools to help them understand how certain factors, such as credit utilization and payment history, are impacting their credit. Wells Fargo also provides access to credit education resources, which can be especially helpful for individuals looking to improve or rebuild their credit.

Key Features:

- Credit Score Provider: FICO Score

- Credit Bureau: Experian

- Update Frequency: Monthly

- Additional Tools: Credit Education, Insights Into Score Factors

Other Free Credit Check Options

Credit. Credit Karma. Credit Karma Dashboard.

Beyond banks, several third-party services allow you to check your credit score for free. These platforms are often accessible to anyone, regardless of whether they hold a bank account with a particular institution.

Credit.com

Credit.com offers a free credit score based on Experian data. This platform uses the VantageScore model and provides personalized insights to help you improve your credit score. It also gives you access to a free credit report card, which breaks down key factors impacting your score.

Credit Karma

One of the most popular tools for checking your credit score for free, Credit Karma provides access to your VantageScore 3.0, based on data from both TransUnion and Equifax. Credit Karma also offers free credit monitoring, so you can receive alerts if there are significant changes to your report. Plus, they provide personalized tips on improving your score and recommendations for financial products based on your credit profile.

Credit Sesame

Credit Sesame offers a free VantageScore 3.0 based on TransUnion data. Similar to Credit Karma, Credit Sesame also provides free credit monitoring, helping you keep track of any changes that might affect your score. The platform offers tailored advice on improving your credit and managing debt.

Mint

Mint, a popular budgeting tool, also offers users the ability to check their free credit score through its platform. Mint uses the VantageScore model, pulling data from TransUnion. Mint users can track their spending, manage budgets, and keep an eye on their credit score — all in one place.

Why Are My Credit Scores Different

Credit. Experian. FICO vs VantageScore Credit Ratings.

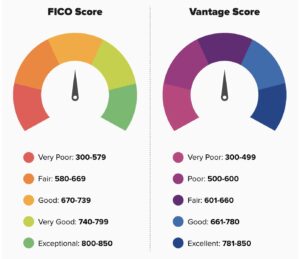

You might notice that your credit score varies depending on where you check it. There are a few reasons for this. First, there are different scoring models: FICO and VantageScore are the two most common. While both are designed to measure creditworthiness, they calculate scores differently, which can lead to variations. Second, your score might differ because each credit bureau (Experian, TransUnion, and Equifax) maintains its own credit report. Not all creditors report to all three bureaus, so the data in your credit reports might differ slightly, which can result in a different score depending on which bureau the platform uses.

Ultimately, the score you see on the website of your bank might not be identical to the one you see on Credit Karma or Credit Sesame, but it should give you a good sense of where your credit stands.

Does Checking Your Credit Score Hurt Your Score

Credit. Dovly. There Are No Negative Consequences To Checking Your Credit Score.

A common concern is whether checking your own credit score can negatively affect it. The good news is that checking your credit score through these free tools is considered a “soft inquiry,” which does not impact your credit score. Soft inquiries occur when you check your own score or when lenders pre-approve you for offers, and they have no effect on your credit.

On the other hand, “hard inquiries” happen when a lender checks your credit as part of a credit application (e.g., for a new loan or credit card). Hard inquiries can temporarily lower your score by a few points, but they typically don’t have a lasting impact. Rest assured, monitoring your own score regularly through free tools will not hurt your credit in any way.

Final Thoughts

Checking your credit score regularly is a smart financial habit, and with so many free tools available, there is no reason not to stay informed. Whether you are using the online portal of your bank or a third-party service like Credit Karma or Credit Sesame, you can monitor your credit without affecting your score. It is important to remember that your credit score might differ slightly depending on where you check it, but as long as you’re staying on top of your credit health, you are in good shape.

By using these free resources, you can make informed decisions about your financial future and stay one step ahead in your credit journey. Now that you know how easy it is to check your credit score for free, take a few minutes to check in and see where you stand — your future self will thank you!